At Africa E-Mobility Week 2025 (14–16 October 2025) in Addis Ababa, Powering Renewable Energy Opportunities (PREO) launched its new report, Driving Interoperability: Insights from PREO’s E-Mobility Portfolio, at a panel discussion addressing a question that will shape the trajectory of Africa’s e-mobility sector: when does collaboration make strategic and commercial sense?

The answer, from both the report and the PREO-supported innovators testing these models, is nuanced. What is clear, however, is that varying forms of interoperability are already informing business planning. Interoperability – the ability of different systems to work together through shared standards and platforms – is proving particularly valuable in high-utilisation commercial fleets, mature markets and capital-intensive infrastructure.

PREO’s contribution reframes interoperability not as universal standardisation, but as creating compatibility at key technical and commercial interfaces. This pragmatic middle path between uniformity and fragmentation is helping to redefine how Africa’s e-mobility sector approaches growth.

Evidence from five years of portfolio experience

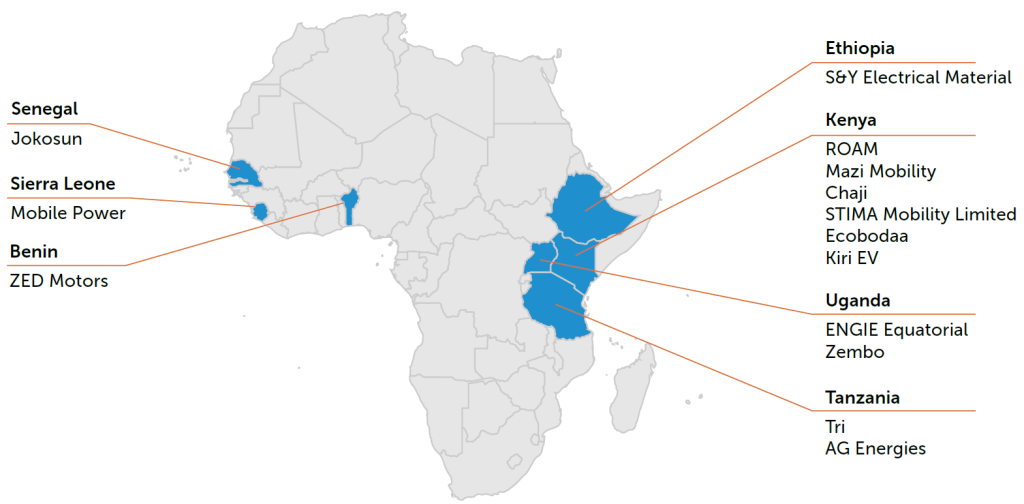

Since 2019, PREO has supported 14 e-mobility companies across sub-Saharan Africa with early-stage investment and technical assistance, as illustrated by the map below.

Delivered by the Carbon Trust and Mercy Corps–Energy 4 Impact, and co-funded by the IKEA Foundation and by UK aid from the British people via the Transforming Energy Access platform, PREO has observed first-hand the challenges created by duplicated infrastructure and closed networks.

The new report draws on this experience to examine when shared infrastructure, batteries and digital platforms can reduce costs and accelerate scale. It features case studies from five companies – Mazi Mobility, AG Energies, CHAJI, STIMA and Ecobodaa – each demonstrating different approaches to compatibility across the value chain.

The economic rationale spans three stakeholder groups. For riders, particularly commercial users such as motorcycle-taxi and delivery drivers, interoperability can reduce downtime, reduce wasted energy, and increase daily earnings through broader network access. For companies, shared systems lower breakeven points through improved asset utilisation. When multiple fleets use the same network, capacity rates rise and infrastructure costs spread across larger user bases. For investors, interoperability reduces capital intensity and increases asset utilisation.

Context determines viability. In early-stage markets with small fleets, vertically integrated systems – where one company controls vehicles, batteries and charging – often remain the fastest route to proving market traction. As markets mature and utilisation rises, the economics shift toward shared approaches.

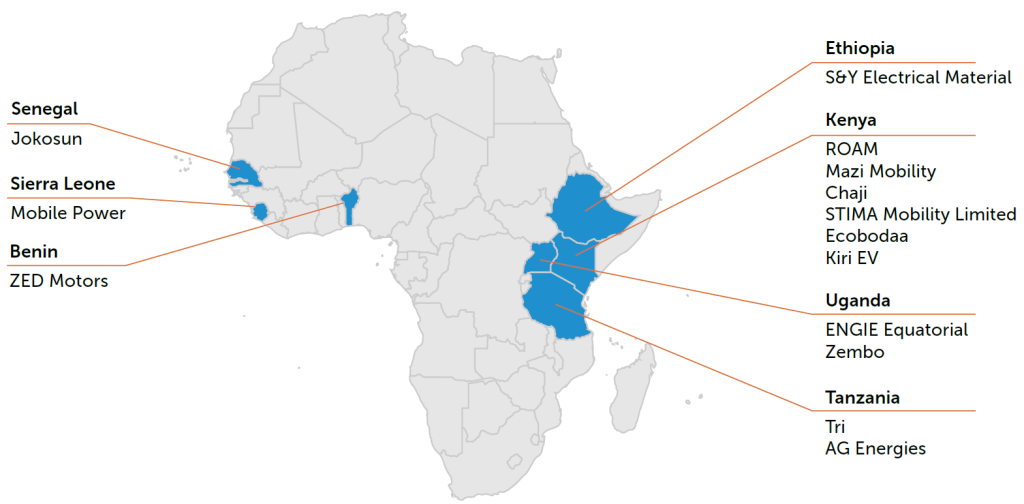

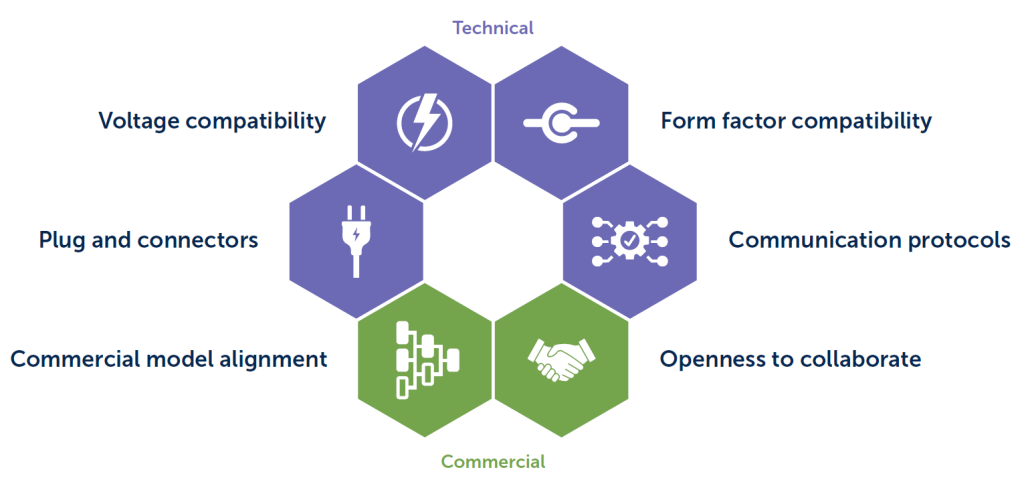

Six building blocks for interoperable systems

The report identifies six foundations for interoperability, as shown in the diagram below. These span both technical and commercial domains, showing that compatibility is as much about trust and transparency as it is about engineering.

At the Africa E-Mobility Week panel, Jason Gras (STIMA), Thatcher Mweu (Mazi Mobility) and Kim Chepkoit (Ecobodaa) discussed what building these foundations requires. All agreed that technical barriers have largely dissolved. Convergence around LFP battery chemistry, voltage standards and form factors means compatibility is now feasible across most electric motorcycles in the region.

The real challenge has shifted to commercial alignment. “For us at Mazi, the technological aspect was much easier to solve than the commercial aspect,” Mweu explained. “Technology takes time, but you can experiment. On the commercial side, you’re asking companies to be transparent about revenue, costs and market share. That’s fundamentally harder.”

Operating shared infrastructure demands deep integration. Companies must align on revenue-sharing, liability and data protocols, coordinating on maintenance and energy procurement. They must reveal cost structures they would normally protect, and trust partners with information that could shift competitive dynamics.

The report highlights a persistent bottleneck: start-ups aspiring to become the dominant battery-swapping network rather than collaborating, creating fragmentation in a sector already short on the capital required to scale. As Gras noted on the panel, collaboration is becoming essential: “Technical convergence has happened. The real challenge now is scaling through finance. Shared investment models such as SPVs can make battery-swapping infrastructure sustainable and bankable.”

His point reflects the high capital demands of building infrastructure. With battery costs around US $500–600 per unit and commercial operations typically requiring around 1.6 batteries per vehicle, electrifying even a quarter of Kenya’s 1.5 million motorcycle-taxi riders would require about USD $330m in battery infrastructure alone.

Matching systems to market realities

For riders, the commercial model matters as much as the technology. At the panel, Chepkoit described how Ecobodaa developed usage-based payment systems because standard swap costs, typically 200–300 Kenyan shillings (USD $1.55-$2.30), do not match drivers’ daily cashflows. “Riders are coming from petrol, where they buy 50 shillings at a time. For interoperability to work on the ground, payment systems must match their cashflows.”

Commercial riders who depend on vehicles for daily income are especially affected by downtime. Access to compatible stations across multiple networks directly improves income stability, making interoperability a business imperative rather than just a technical exercise.

Closing the panel discussion, Tom Courtright of PREO delivery partner Mercy Corps – Energy 4 Impact emphasised that this level of collaboration requires unusual transparency. “You need to share cost centres, electricity procurement details, even communication protocols. True interoperability goes beyond hardware, it requires openness and trust. But there’s no single formula. When companies share data, costs and risks, collaboration becomes the engine of sector-wide growth.”

Negotiated alignment, not mandated standards

A theme that emerged repeatedly at Africa E-Mobility Week was that interoperability should not mean rigid, government-imposed technical standards. The sector is instead moving toward “negotiated standardisation”: gradual alignment through dialogue between companies, regulators and financiers, allowing innovation to continue while ensuring compatibility where it supports business models and improves safety and efficiency.

This approach reflects the diversity of business models, infrastructure conditions and user needs that characterise African markets. Imposing universal standards prematurely risks stifling the experimentation needed to discover what works commercially across contexts. As Gras observed, “We’re much more in favour of a consortium approach – companies wanting to join hands and collaborate to deploy at a much larger pace.”

Building rails, not walls

The record number of delegates this year in Addis Ababa underscored a sector moving from proof-of-concept to early scale. PREO’s report and panel discussion reflect a maturing understanding of how the sector approaches growth.

The shift from “Should we standardise?” to “Where does collaboration add value?” acknowledges that Africa’s e-mobility future will be plural: interoperable where economics justify it, closed where they do not, with different models serving different user segments and market conditions.

Looking forward, the report closes with a four-part roadmap: build the technical rails (modular designs, dual-voltage support); enable shared infrastructure platforms (co-financed with multi-brand access guarantees); align commercial models (standardised revenue-sharing contracts); and create soft regulatory guardrails (signalling preferred specifications without mandating uniformity).

As utilisation rises and markets mature, the case for shared systems will strengthen. Yet success will depend on more than technical alignment. The path to scale runs through collaboration built on assessment of where sharing creates value. As PREO’s report suggests, the question is not whether to build walls or open systems, but how to build the rails that let different operators run on shared infrastructure while remaining competitive.

Angus Vantoch-Wood of The Carbon Trust, which delivers PREO, observed, “The energy and diversity of innovators at this year’s Africa E-Mobility Week show how quickly the sector is maturing. Collaboration is becoming a commercial necessity, and interoperability – where it makes sense – is part of that evolution.”

Download the report: Driving Interoperability: Insights from PREO’s E-Mobility Portfolio